FlexiKYC against societal issues

KYC societal struggles

The amount of illicit financial flows in the world is estimated at around 2 to 5% of global GDP, or between $800 billion and $2 trillion annually."

Kenneth Rogoff, Economist and Professor at Harvard University

FlexiKYC: A Modern Solution for Financial Inclusion, Financial Crime Prevention, and Improved Customer Experience"

FlexiKYC aims to strike a balance between compliance with regulatory requirements and the need to provide a convenient and efficient customer experience. FlexiKYC goes beyond the traditional KYC system by using flexible and non-invasive methods of identification and verification, such as digital identity authentication and biometrics, while still complying with the regulatory requirements.

Indeed, he can help address societal issues such as financial inclusion, as it allows for simpler, more accessible, and more convenient ways for individuals and small businesses to access financial services. It can also help improve the customer experience by reducing the time and effort required for customer onboarding, which can be particularly beneficial for vulnerable populations such as the older people, low-income individuals, and rural customers.

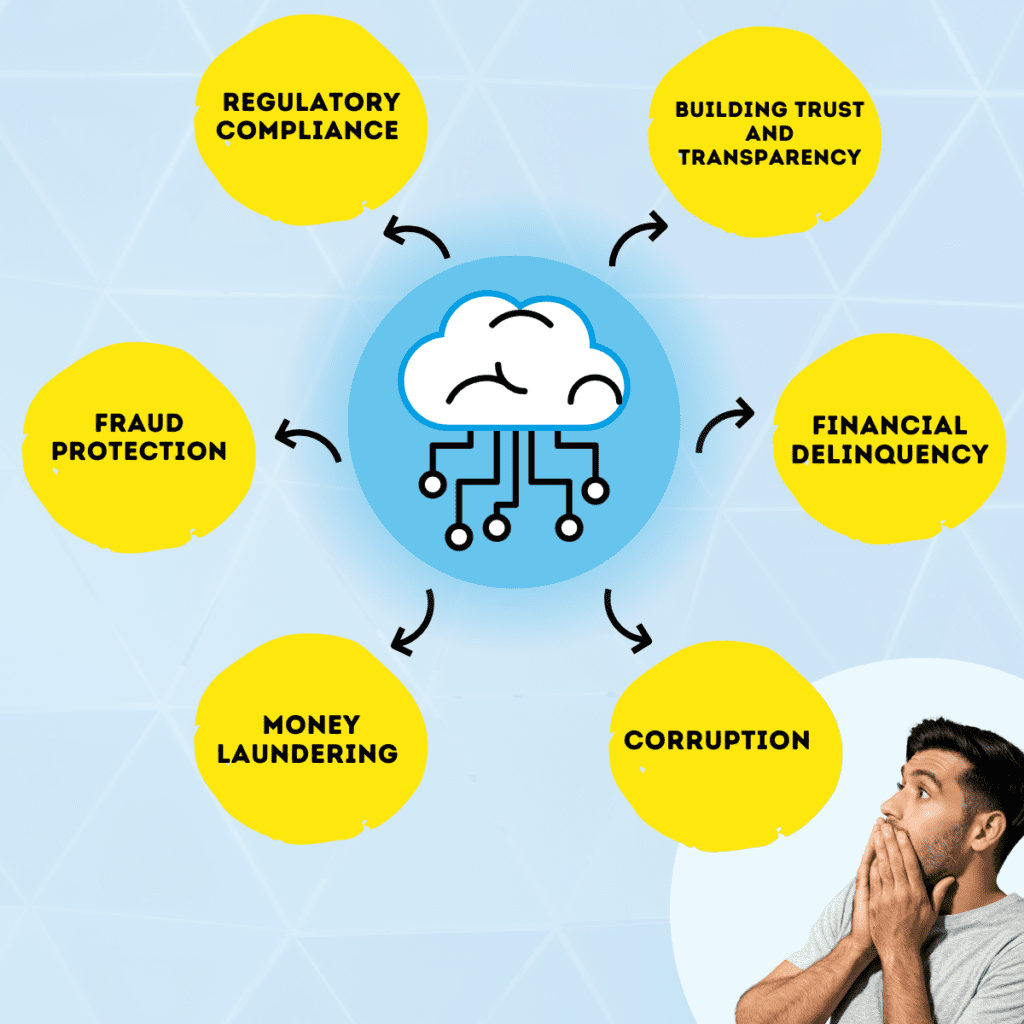

KYC can also support in preventing financial crimes. By providing a flexible approach to compliance, it helps to identify and prevent money laundering and terrorist financing activities, while also reducing the risk of fraud and other financial crimes. It can also help to increase transparency and trust in the financial system, which is essential for maintaining stability and security for all stakeholders.

In summary, FlexiKYC is a modern approach to KYC system that can improve the customer experience and help to address societal issues such as financial inclusion, financial crimes and frauds, while ensuring compliance with regulatory requirements. By providing a flexible and efficient solution, FlexiKYC can help businesses and financial institutions to effectively identify and verify their customers while minimizing the risk of financial crimes, making the system more secure and stable for everyone.

Setting up a KYC system: a necessity to fight money laundering and financial fraud

It is important to note that figures on the effectiveness of anti-money laundering and combating the financing of terrorism through the Know Your Customer (KYC) system may vary depending on the source and methodology used. However, several studies and international organizations have provided estimates on the financial and social benefits of implementing KYC.

According to the International Monetary Fund (IMF), the amount of illicit financial flows in the world is estimated to be around 2-5% of global GDP, or between $800 billion and $2 trillion per year. The Organization for Economic Cooperation and Development (OECD) estimates that the cost of combating money laundering and terrorist financing is between 0.1% and 0.5% of GDP for OECD countries.

In 2017, the FATF (Financial Action Task Force) notified that money laundering-related activities cost between $800 billion and $2 trillion per year. The losses associated with financial fraud can also be significant, especially for small businesses and individuals. According to the European Union, payment card fraud costs merchants approximately €1.5 billion per year.